Ready to grow your business?

Streamlining your hiring and employee management

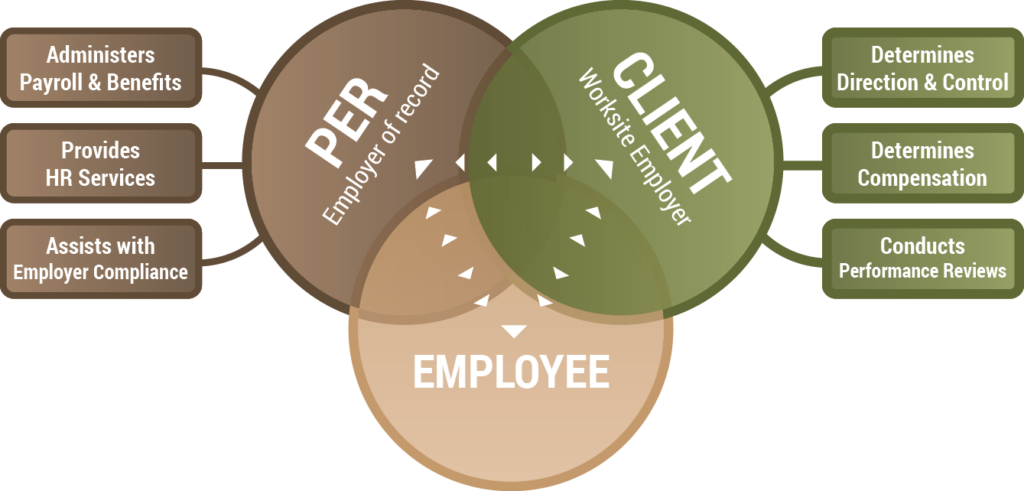

Co-employment is a contractual arrangement where a business and a professional employer organization (PEO) share distinct employment obligations. Within the co-employment relationships of our clients, we typically assume responsibility for all payroll obligations and tax filings, making us the “employer of record” for taxation and insurance purposes.

Additional services can also be contracted out to our team, including health benefits, welfare, retirement benefits, and all the associated administrative paperwork. Your employees are deployed to you under a contract that defines the respective responsibilities and liabilities of both your business and us as the PEO. You remain in control of day-to-day direction such as hiring and firing.

Ready to grow your business?